Rumored Buzz on Offshore Wealth Management

They can supply you with the option of a regular income and additionally aid you to lower your individual liability to Revenue as well as Capital Gains Tax Obligation. The value of an investment with St. offshore wealth management. James's Area will be straight linked to the performance of the funds you choose and also the value can consequently decrease along with up.

The levels as well as bases of taxes, and remedies for taxes, can change at any kind of time. The worth of any type of tax obligation relief relies on individual conditions.

Get This Report about Offshore Wealth Management

Several capitalists make use of standard financial investments like a genuine estate and financial items, at taken care of prices. From the long-lasting investment perspective, it can be much wiser to spend in funding holders whose performance is constantly extra appealing.

Depends on are exceptional investment vehicles to shield assets, and they have the capability to hold a vast variety of possession classes, consisting of residential or commercial property, shares and art or antiques - offshore wealth management. They likewise allow for reliable distribution of assets to recipients. An offshore trust that is managed in a safe jurisdiction allows for reliable riches creation, tax-efficient management and also sequence preparation.

The Greatest Guide To Offshore Wealth Management

Clients who fear that their possessions may be frozen or taken in the occasion of potential political turmoil view offshore banking as an attractive, risk-free means to protect their assets. Numerous offshore accounts thin down the political risk to their wide range and decrease the danger of them having their properties frozen or taken in a recession.

With enhanced tax obligation openness and firm of worldwide regulations, it has actually ended up being much more hard for individuals to open overseas accounts. The worldwide crackdown on tax obligation avoidance has made offshore much less appealing and Switzerland, in particular, has seen a decline in the number of overseas accounts being opened up.

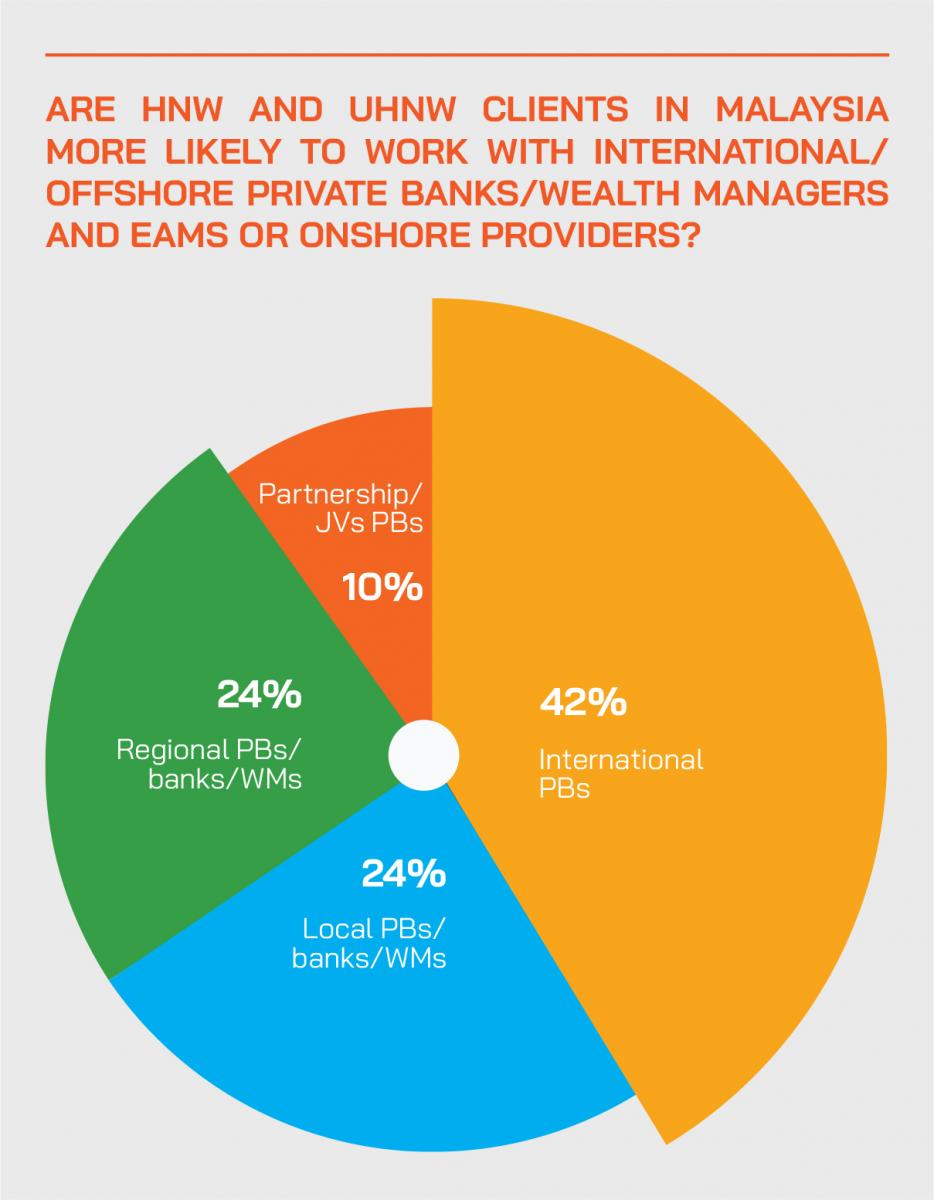

Onshore, offshore or a mix of both will compose a personal banker's client base. The equilibrium for every lender will be various depending upon where their customers want to schedule their possessions. Functioning with offshore customers requires a somewhat different strategy to onshore clients and also can include the adhering to on the part of the lender: They might be required to go across borders to check out clients in their residence country, also when the banks they belong to click now does not have a long-term facility located there, Possibly take full obligation for taking care of portfolio for the customer if the customer is not a local, Be multilingual in order to properly interact with customers as well as construct their client base internationally, Know global laws as well as regulations, especially with concerns to overseas investments as well as tax obligation, Be able to connect their clients to the right experts to aid them with different areas from tax with to even more practical support such as helping with building, relocation, immigration advisors and also education professionals, Know the most up to date problems impacting worldwide clients as well as guarantee they can develop remedies to fulfill their demands, The financial institution and also certain group within will figure their explanation out the populace of a banker's customer base.

Things about Offshore Wealth Management

Associates to the larger financial services sector in offshore facilities Offshore financial investment is the keeping of cash in a jurisdiction various other than one's country of house. Offshore jurisdictions are used to pay much less tax obligation in lots of countries by huge and small capitalists.

The benefit to offshore financial investment is that such procedures are both legal and also less costly than those supplied in the financier's countryor "onshore". Places preferred by investors for low prices of tax are referred to as overseas monetary centers or (often) tax obligation places. Settlement of less tax is the driving force behind the majority of 'offshore' activity.

Frequently, taxes levied by an investor's house country are important to the productivity of any given investment - offshore wealth management. Using offshore-domiciled special purpose mechanisms (or cars) a financier may decrease the amount of tax payable, enabling the financier to accomplish higher earnings on the whole. An additional factor why 'offshore' financial investment is considered above 'onshore' investment is due to the fact that it is less regulated, and the behavior of the overseas financial investment provider, whether he be a lender, fund supervisor, trustee or stock-broker, is freer than it might be in a much more regulated environment.

See This Report on Offshore Wealth Management

Guarding versus money decrease - As an example, Chinese investors have been investing their savings in stable Offshore locations to safeguard their against the decline of the renminbi. Continued Offshore investments in badly regulated tax havens may bypass sanctions against nations developed to urge conventions vital to cultures (e.Corporations are firms created quickly Produced and, as well as they are heavily taxed on Exhausted operations, they pay no taxes on foreign activities. As a result, more than of 45,000 offshore covering business and also subsidiaries companies are created in Panama each year; Panama has one of the highest focus of subsidiaries of any nation in the globe.

Comments on “The Offshore Wealth Management PDFs”